Theodore Lowe, Ap #867-859 Sit Rd, Azusa New York

Theodore Lowe, Ap #867-859 Sit Rd, Azusa New York

Auto insurance agencies handle a steady flow of work. Emails arrive throughout the day. Calls are returned. Documents are reviewed and filed. Renewals move in the background. Claims develop across days or weeks.

Each task involves gathering information, confirming transactional history, and updating records so the next step is clear. The work is shaped by how consistently these steps line up.

Over the past year, Auto Insurance AI workflows have been assisting with this coordination. They summarize documents, prepare short internal notes, surface follow-ups, and draft messages. They sit alongside existing systems and reduce the amount of data that a human agent needs to process at a given moment.

This post outlines 15 workflows that are already being used by agencies. Each workflow is small, familiar, and can be tested without changing systems or retraining teams.

This guide is meant for people who spend their workday inside an auto insurance agency. People who move between emails, calls, carrier portals, documents, and internal notes. People who keep track of details across many accounts at the same time. The guide describes how Auto Insurance AI workflows are being used today in work, without changing the structure of how agencies operate. The workflows described here will feel familiar if your day includes any of the following roles or responsibilities.

You focus on making sure the agency runs steadily. You look at new business volume, retention, carrier relationships, staffing, and client experience. You see patterns across the whole book. Much of your day involves checking in, answering questions, and helping the team keep pace when things stack up. You have context across everything, and you’re always looking for ways to reduce operational strain without disrupting what already works.

You move across many small tasks throughout the day. A client requests an ID card. Someone needs wording for a certificate. A renewal date is approaching and requires preparation. These tasks are usually clear, and the steps are known. The work is to keep each item progressing, especially when several are active at once. Consistency and timing shape the day.

You handle information that unfolds over time. A claim starts small and develops gradually. There are emails, phone calls, photos, estimates, documents, and statements. Each update needs to be stored and understood in relation to the previous events. Claim coordination and adjustment work is often steady and patient, with moments that require fast response. Keeping everything organized matters as the claim continues.

You work with clients who have multiple vehicles, drivers, renewals, and updates happening throughout the year. There are changes to ownership, garaging addresses, certificates, and new additions. The work involves staying aware of the current state of each account while preparing for what’s coming next. Written notes and consistent summaries are important, because context accumulates over months.

You are responsible for how work moves between people and systems. You notice when something waits too long, when steps are repeated, and when information is captured in one place but needed in another. You watch for bottlenecks and look for patterns. You think in terms of what stays stable and what needs adjustment.

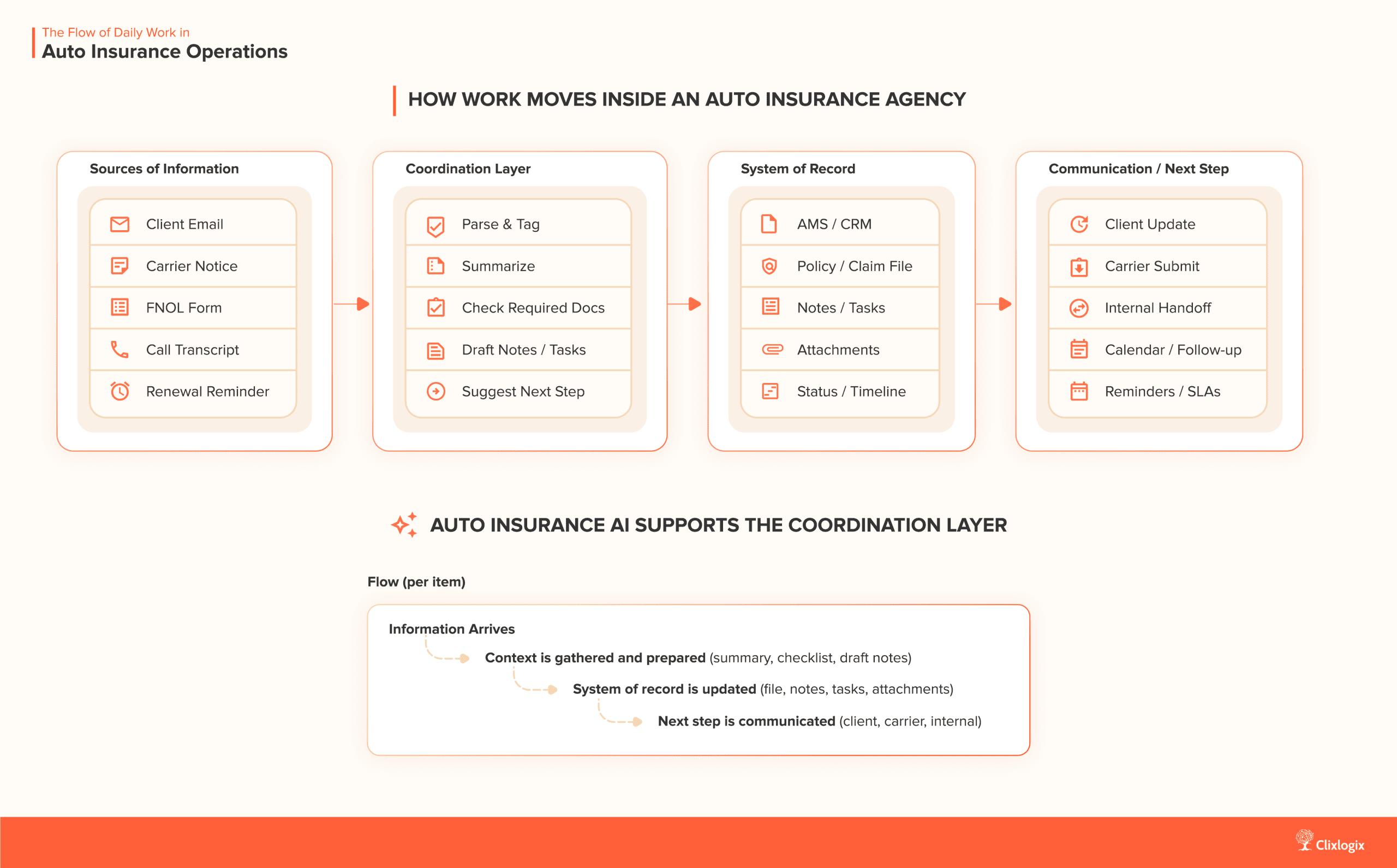

Inside an auto insurance agency, most work follows a recurring sequence. A client reaches out, a carrier sends a notice, a claim develops, or a renewal date approaches. Information arrives from outside the agency or from a previous step in a process.

From there, the work continues through a set of quiet steps that repeat throughout the day:

Each workflow in the agency fits into this sequence. The form of the work changes – emails, calls, forms, certificates, renewals, claims, but the movement stays steady. The pace of the day depends on how smoothly this sequence continues across accounts and tasks.

Much of the operational effort goes into making sure these steps follow one another without pause. But with these many active threads, keeping everything aligned becomes a problem . This is where Auto Insurance AI workflows have become useful. They support the continuity of work by preparing context, drafting summaries, and organizing what needs to happen next.

The workflows described in this post strengthen one link in this sequence at a time. They are small adjustments that help the work stay in motion.

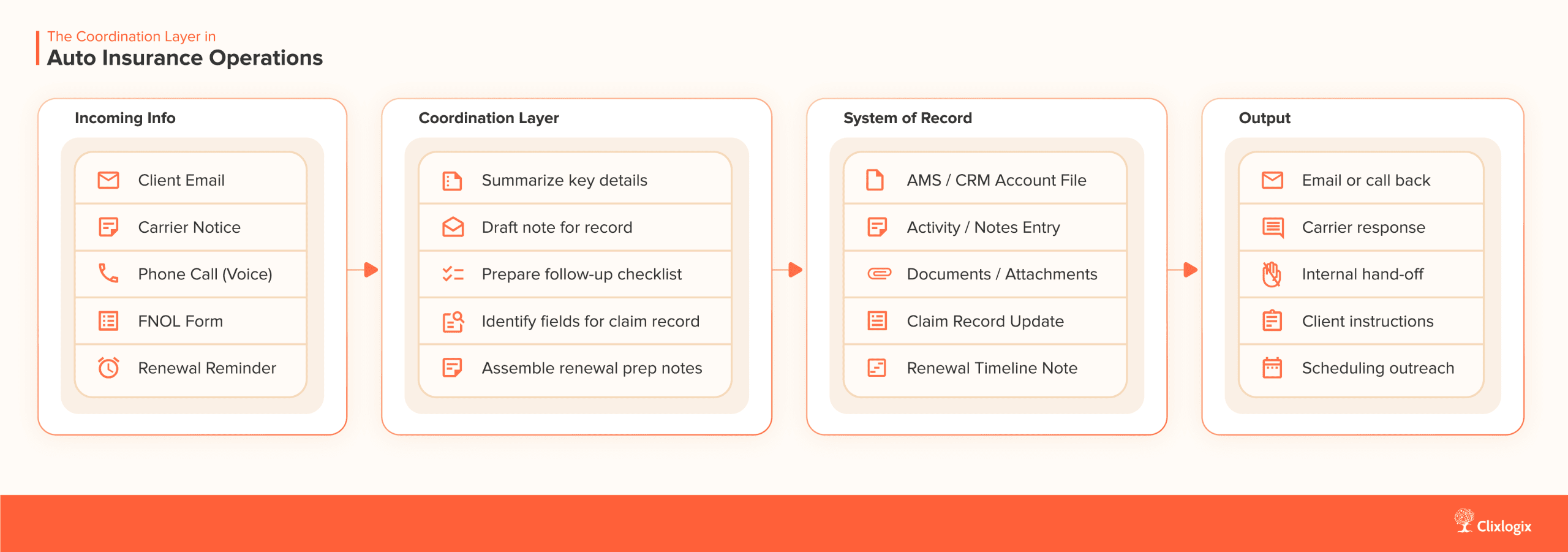

Auto insurance agencies organize their work around a primary system of record. This may be an agency management system (AMS), a CRM, or both used together. These systems store policy information, account details, documents, activity logs, and claim records. Most daily tasks begin with retrieving information from this system and end with updating it. The system of record stays unchanged.

The coordination layer around the system of record assists with the movement of information before and after it is stored. It prepares summaries, drafts notes, and structures next steps. It reduces the amount of context a person needs to hold while working across multiple accounts.

This layer does not alter coverage, replace judgment, or automate decision-making. It supports the flow of information so the work continues steadily. It can be introduced gradually, one workflow at a time, without changing existing tools or retraining teams.

The coordination layer can be described in three parts:

| Layer | Examples | What This Layer Does |

|---|---|---|

| Workflow Sequencing | n8n, Make, internal routing rules | Guides each task through a predictable sequence of steps. |

| AI Processing | Claude, GPT-4.1, Gemini | Summarizes documents, prepares short internal notes, organizes information for entry into the system of record. |

| Voice (Optional) | Deepgram, Assembly, Whisper.cpp | Converts calls and voicemail into structured written text that can be reviewed or stored. |

These layers work together when needed. Some workflows use only sequencing. Some use the AI processing layer to prepare summaries. Some use the voice layer when call-driven work is common. The arrangement is flexible.

The Auto Insurance AI coordination layer sits between incoming information and the system of record. It prepares what will be recorded and shapes what will happen next.

This can be seen more clearly in the structure of a single task:

This structure repeats across renewals, service requests, claims, and account maintenance. The format changes, but the movement is consistent. Information arrives, is understood, is recorded, and is carried forward.

The coordination layer supports the movement between steps. It prepares context so the person doing the work has what they need at the moment they need it.

This foundation supports all of the workflows described in the next section. It can be added gradually, without altering the systems that agencies already rely on.

Each workflow in the next section strengthens one part of this movement. The workflows are small, specific, and familiar to agency staff. They can be introduced one at a time.

The workflows below use a small coordination layer around the system of record. The systems already in use (AMS or CRM) remain unchanged. The coordination layer prepares summaries, drafts notes, structures follow-ups, and brings information back into view when needed.

This layer has three parts:

| Layer | Examples | Purpose |

|---|---|---|

| Orchestration | n8n, Make, or internal routing rules | Moves each workflow through a consistent sequence of steps. |

| AI Processing | Claude 3, GPT-4.1, Gemini | Summarizes documents, prepares short explanations, and organizes context before it is recorded. |

| Voice (Optional) | Deepgram, Assembly, Whisper.cpp | Converts calls and voicemail into structured written notes. |

Not every workflow uses every part of the layer. Some use orchestration alone. Some use only summarization. The system of record (AMS or CRM) remains unchanged. The workflows sit around existing tools and routines.

What it Addresses

Updates relevant to renewal (driver changes, garaging adjustments, endorsement notes, mileage updates, and minor claim details) may be stored across email threads, call notes, and system activity over the course of the policy term. Before renewal outreach, this information needs to be brought together.

How it Works

The workflow reviews recent activity tied to the account and prepares a short internal summary for the renewal conversation. It looks at the sources your team already uses, emails, call notes, endorsements, and documents stored in the AMS or CRM and organizes the key updates into a clean, readable format.

Here is what the AI layer specifically does:

The AMS or CRM remains the system of record. The workflow just prepares a clear starting point so the renewal call begins with shared context rather than reconstruction.

Tools you can use

| Layer | Common Options |

|---|---|

| Workflow Sequencing | n8n, Make |

| AI Processing | Claude 3, GPT-4.1, Gemini |

| Voice Processing (optional) | Deepgram, Whisper.cpp |

How teams actually use it

A CSR or account manager reviews the summary before the renewal call or message. It provides a single reference point without needing to re-open earlier threads or notes.

Try this next week

Select one renewal scheduled 30 to 45 days out. Generate an internal summary and use it as the reference for the initial renewal touchpoint.

What it addresses

During renewal or new business quoting, coverage options and premium variations may come from different carrier systems or rating portals. Limits, deductibles, and optional endorsements are often reviewed together. This information benefits from being shown in a single, easy-to-read internal summary before communicating with the client.

How it works

The workflow collects quote outputs from carrier systems, raters, or broker portals and formats them into a short comparison table. It typically lists liability limits, physical damage selections, deductibles, uninsured/underinsured motorist coverage, and any optional endorsements. The summary is for internal use when preparing to discuss options.

The AI layer reads the quote documents, interprets the structure even when formats differ, aligns the limits and deductibles, highlights notable differences, and prepares an optional plain-language explanation that the CSR or producer can edit before sending. The AMS or CRM remains the system of record; the workflow simply prepares a cleaner reference for the decision conversation.

Tools you can use

| Layer | Common Options |

|---|---|

| Workflow Sequencing | n8n, Make |

| AI Processing | Claude 3, GPT-4.1, Gemini |

Voice processing is rarely used here, so it is optional and not typically included.

How teams actually use it

A CSR or account manager refers to the comparison summary during the renewal discussion. It keeps the conversation focused and organized without switching across multiple windows or files.

Try this next week

Select one renewal where multiple carrier quotes are expected. Generate a comparison summary and use it to guide the renewal discussion.

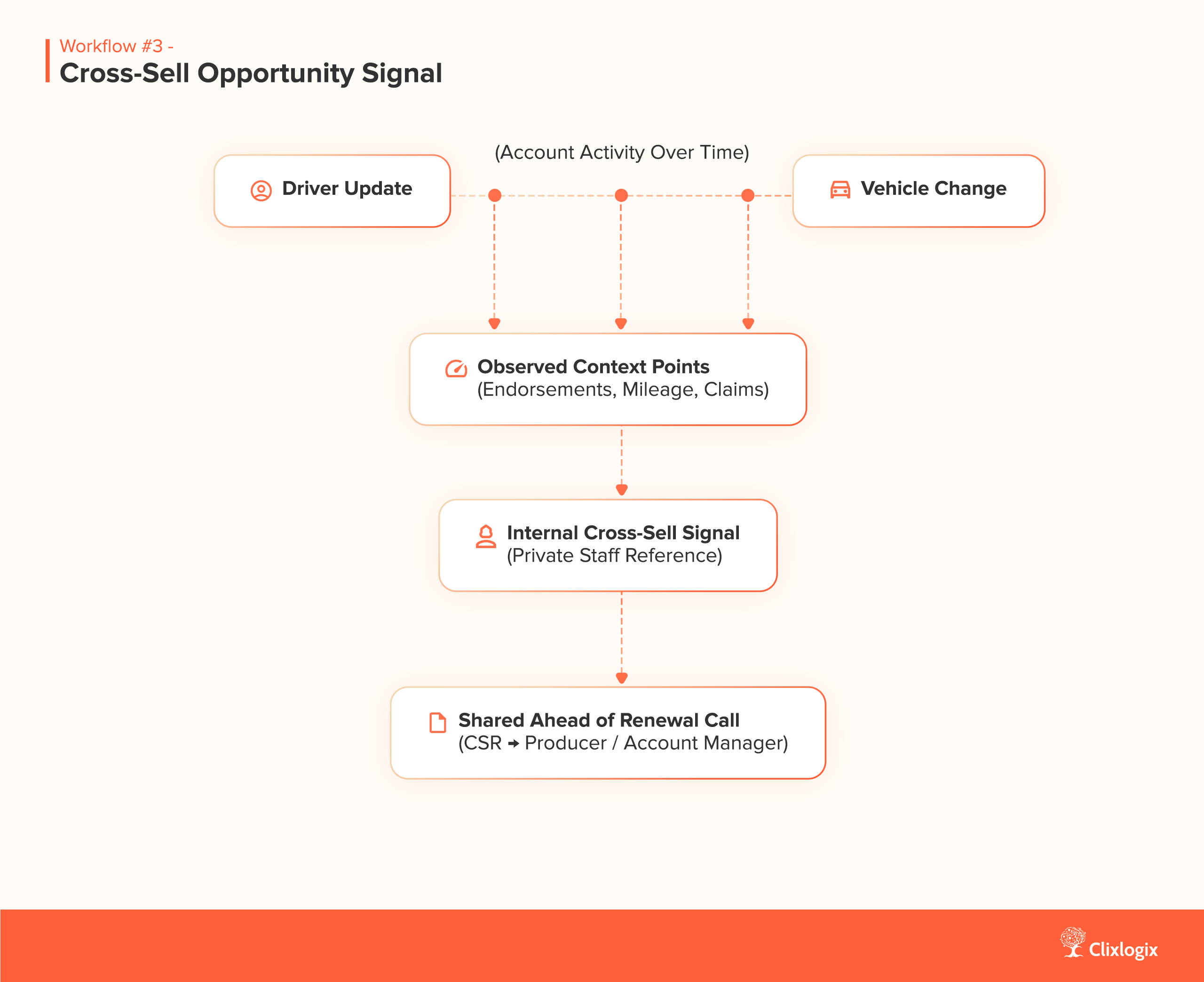

What it addresses

During routine service work, renewal conversations, and claim follow-ups, staff often encounter information that may indicate a need for additional coverage. These details may be mentioned briefly and not documented in a way that is easy to reference later. This workflow supports that moment by noticing those signals and presenting them at the right time, so the team doesn’t have to remember every detail manually.

How it works

The workflow reviews recent interactions and organizes the signals that may point to additional coverage needs like new vehicles, new drivers, changes in use, or shifts in client circumstances.

The team continues its normal work, and the workflow prepares a short internal note when a potential opportunity appears. On the software side, the orchestration layer pulls in the emails, call summaries. Then a semantic interpretation cycle takes place. Once a positive has been realized, AI updates records in the AMS or CRM. All this happens by looking for the key phrases and structured fields that matter, followed by AI organizing them into a short recommendation within designated fields.

AI in the workflow reads the interactions, understands the context behind each update, connects it to the coverage patterns inside the account, and prepares a simple explanation that the agent or CSR can review before deciding whether to reach out. The AMS or CRM remains the system of record, the workflow simply surfaces patterns the team would otherwise have to track manually.

Tools (using the shared layers defined earlier)

| Layer | Common Options |

|---|---|

| Workflow Sequencing | n8n, Make |

| AI Processing | Claude 3, GPT-4.1, Gemini |

| Voice Processing (optional) | Deepgram, Whisper.cpp |

How teams use it

A CSR or Account Manager reads the internal note when preparing for a renewal touchpoint or scheduled service call. If applicable, the Producer is informed so they can include the item when speaking with the client. The note remains internal and does not change how the client conversation is initiated; it provides context that is available if it becomes relevant in the discussion.

Try this next week

Choose one account scheduled for renewal review. Generate a short internal note highlighting any possible related policy discussions. Keep it on hand when preparing for the renewal call.

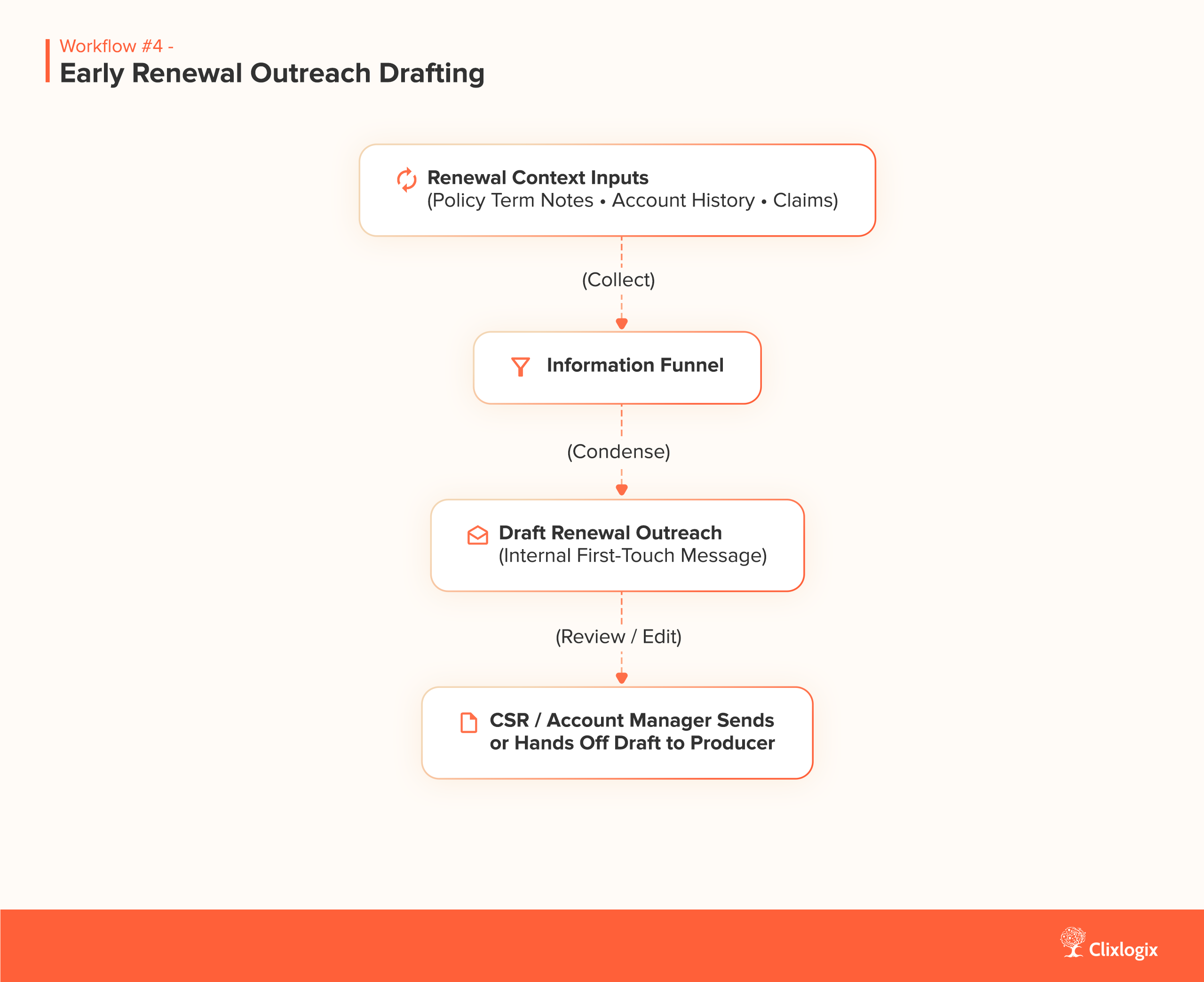

What it addresses

Renewal outreach often begins with a simple first contact. This outreach may reference policy status, prior updates, claims, or known changes. Drafting this initial message can require reviewing past notes or email threads to ensure the communication is accurate and complete. This coordination happens repeatedly across the month, and the quality of the outreach depends on how clearly the prior interactions are recalled. This workflow supports that moment by preparing a simple, accurate starting point for the outreach message. This workflow supports that moment by preparing a simple, accurate starting point for the outreach message.

How it works

The workflow looks at upcoming renewals and pulls the pieces of information a CSR normally checks before drafting the first message. It retrieves the renewal date from the AMS or CRM, reviews the last term’s activity, and gathers the items that typically shape early outreach. It analyzes fields like recent endorsements, driver and vehicle updates, address or garaging changes, open service requests, and any client messages that may influence quoting.

The orchestration layer queries recent activity like endorsements, new drivers, garaging updates, mileage changes, open tasks, and email threads. A mix of API calls, document parsing, and inbox routing rules enable this querying of policy activity.

Once the raw inputs are collected, AI processes them through a structured pipeline: the text is chunked, embedded, and context-ranked so only the relevant pieces are surfaced, then a domain-tuned model (GPT-4.1, Claude 3, or equivalent) synthesizes the updates into a renewal-specific context block. The model uses that block to generate a first-draft outreach note that reflects the client’s recent interactions, incorporates prior changes accurately, and follows the agency’s communication style. The draft is stored internally and is never sent automatically. No AMS/CRM records are changed at any point.

Tools (using the shared layers defined earlier)

| Layer | Common Options |

|---|---|

| Workflow Sequencing | n8n, Make |

| AI Processing | Claude 3, GPT-4.1, Gemini |

How teams use it

A CSR or Account Manager opens the draft message when planning initial renewal communication. The message is reviewed and edited to match the account’s context and the agency’s communication style. If the Producer will be the one conducting the renewal discussion, the CSR prepares the draft and hands it off for final sending.

Try this next week

Select one renewal approximately 30 days out. Generate a first-touch renewal draft. Review and edit, then use it as the initial contact message.

What it addresses

Coverage questions often arise when a client is reviewing a renewal, adjusting a vehicle, adding a driver, or asking about potential claims. Policy language, endorsement wording, and carrier documentation may be long or technical. Teams typically translate the coverage language manually into something a client can understand. This workflow supports that moment by preparing a clear explanation that matches the client’s context and the agency’s communication style. A short explanation created by this workflow helps support the discussion.

How it works

The workflow collects the relevant policy information like:

All this can be fetched from the AMS or CRM using standard API calls or document retrieval. The orchestration layer processes the dec pages, carrier documents, and quote summaries through a document-parsing step that converts the PDFs or API payload into structured text blocks.

These blocks are then passed through an embedding model to identify the sections related to the specific question or coverage being explained. AI can then use those ranked sections and synthesize them into a short explanation written in everyday language.

The model stays within the exact policy terms and does not infer or modify coverage, it simply reframes the carrier’s wording into something easier for a client to understand.

Example: Client asks “Can you explain what the $1,000 Comprehensive Deductible means?”

AI generates an explanation – “Your policy includes a $1,000 comprehensive deductible. This applies when the vehicle is damaged by something other than a collision, for example, theft, vandalism, fire, hail, falling objects, or hitting an animal. If one of these events occurs, you would pay the first $1,000 of the repair cost, and the carrier would cover the rest up to the limits of the policy. This deductible does not apply to collision-related damage and doesn’t affect liability coverage. Nothing has changed about this coverage during the current policy term.”

Tools (using the shared layers defined earlier)

| Layer | Common Options |

|---|---|

| Workflow Sequencing | n8n, Make |

| AI Processing | Claude 3, GPT-4.1, Gemini |

How teams use it

A CSR or Account Manager reviews the explanation while preparing for a client call or when responding to a service request. If the Producer is leading the conversation, the CSR prepares the explanation and provides it as a pre-conversation reference. The explanation may be sent to the client as an email paragraph or used verbally during the call.

Try this next week

Select one account where a client has asked a coverage question recently. Generate a short explanation for internal review, then use it to guide the response.

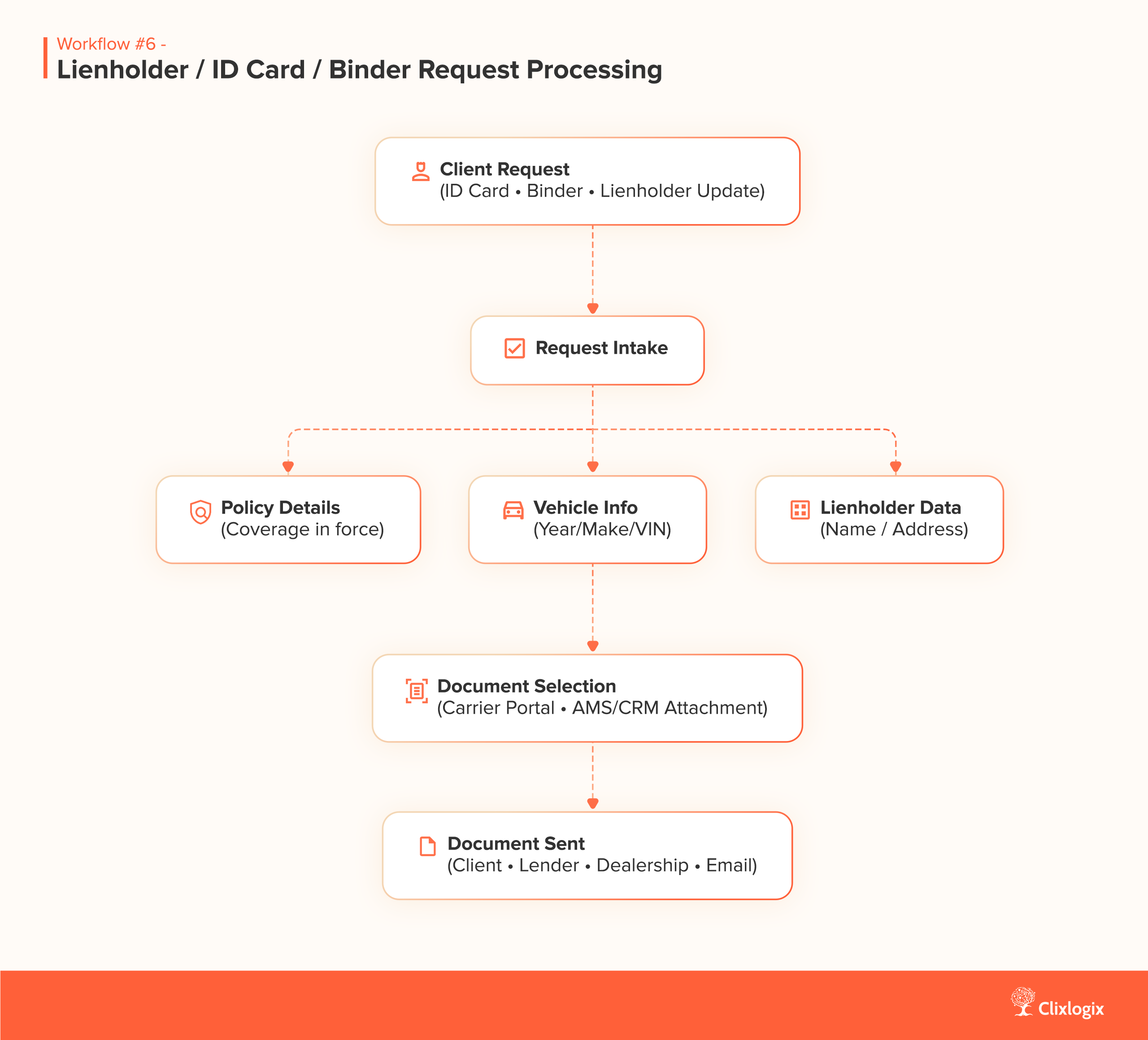

What it addresses

Requests for updated ID cards, proof of insurance, or binder documents often come through email or phone. These requests may involve verifying policy status, confirming lienholder or lender details, or checking that coverage information is current. Each request requires bringing the relevant account details into view before sending documents.

How it works

The workflow routes incoming requests from the shared inbox or a forwarding address and links them to the correct policy using account identifiers found in the message or inferred from context.

The orchestration layer then retrieves the relevant fields from the AMS or CRM, vehicle details, coverage specifics, lienholder information, effective dates, and any recent endorsements, using API calls or file lookups. Carrier documents such as ID cards or binders are retrieved or regenerated depending on the carrier system the agency uses. These raw inputs are processed through a document-parsing step that structures the coverage and vehicle data into clean text blocks.

AI reviews the request message, interprets what the client is asking for, identifies any missing elements that the CSR may need to confirm, and prepares a short internal draft summarizing the request context, the associated policy components, and the steps required to fulfill it.

It can also generate a first-draft email the CSR can edit before sending.

Tools (using the shared layers defined earlier)

| Layer | Common Options |

|---|---|

| Workflow Sequencing | n8n, Make |

| AI Processing | Claude 3, GPT-4.1, Gemini |

Voice processing is optional here and used only when requests arrive via voicemail.

How teams use it

A CSR receives the request, opens the prepared reference, and verifies that the document reflects current policy terms. If the request involves a lender or lienholder change, the CSR updates the system of record and notes the change. The Account Manager or Producer is notified only if further review is needed, such as coverage changes or mid-term adjustments.

Try this next week

Take one incoming ID card or binder request. Generate the internal reference summary first, then use it to complete the request and record the update.

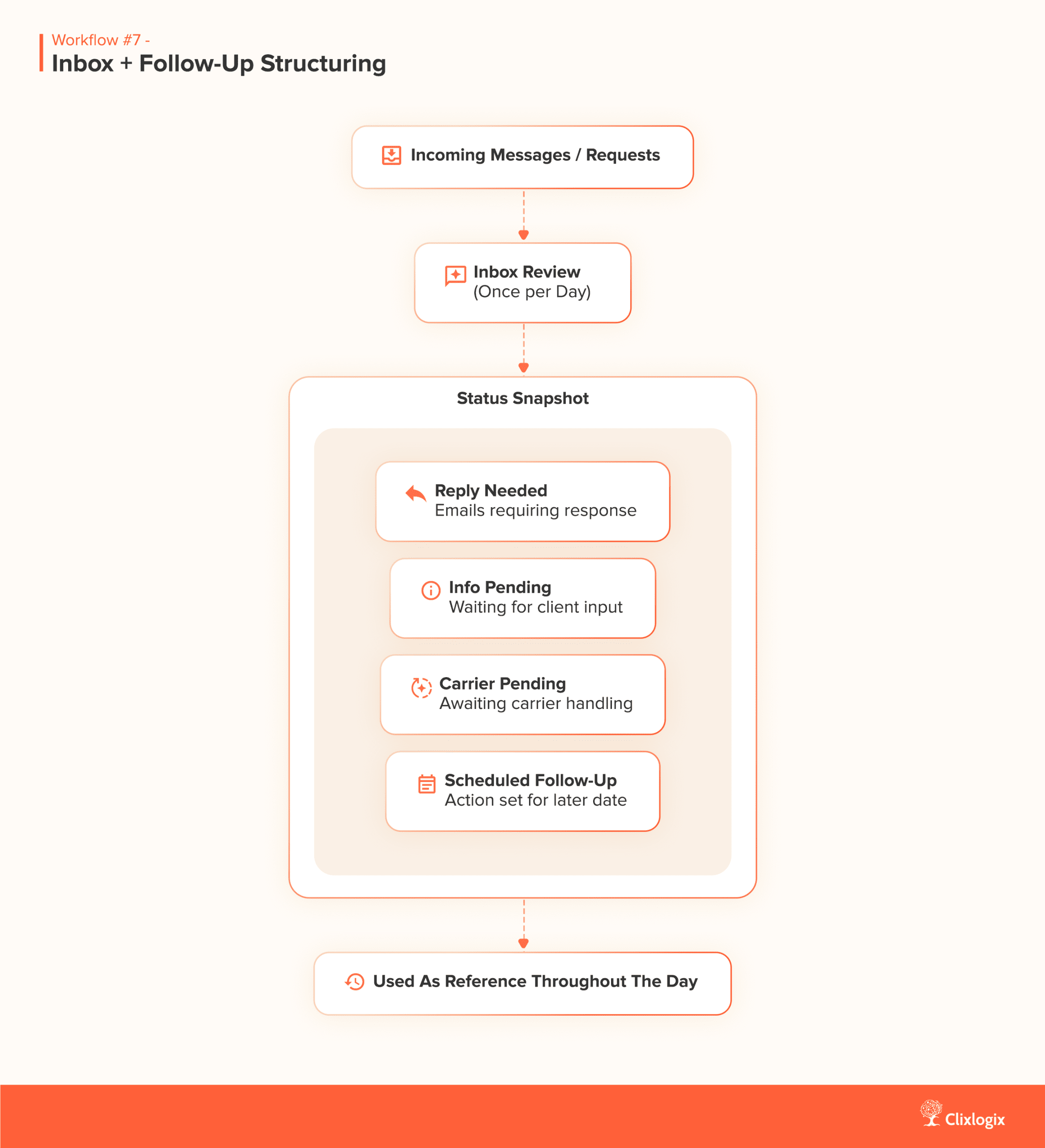

What it addresses

A significant amount of agency work enters through the inbox. These are items like renewal questions, change requests, carrier notices, claim updates, and general servicing tasks. In our work with dozens of agencies we observe that servicing teams can easily manage 100+ incoming messages weekly when book size is 1,000+ policies. Some require immediate action, others need information gathered, and others depend on responses from carriers or clients. Tracking these requests across email, AMS/CRM tasks, and personal reminders can require re-checking multiple sources to confirm what is pending.

How it works

This workflow reviews the inbox or service queue and generates a short list of active items with their current status and next step. Each item is labeled as: reply needed, information pending, carrier response pending, or scheduled follow-up. The list is used internally as a reference during the day.

The orchestration layer retrieves the relevant policy information like active vehicles, recent endorsements, coverage changes, open tasks, or claims activity using API calls to the AMS or CRM. These details are combined with the raw email content and passed into a parsing stage that extracts dates, request types, policy numbers, and any documents attached to the message.

An AI engine processes an email in its original language, interprets the request or update being communicated. It looks at the words the client used, the tone, the timing of the request, and any references to prior conversations. It matches these against the account context the orchestration layer gathered, which helps it understand what the client is actually trying to do.

From there, the AI component drafts a short internal summary. Shaping of this summary starts by isolating the part of the message that carries the client’s intent, usually one or two sentences hidden between greetings, signatures, or older thread history. It anchors that text to the account context already pulled from the AMS or CRM, so if the client mentions a vehicle, a driver, or a date, the component knows exactly which record it belongs to. Once the intent is clear, it reconstructs the request in plain language and ties it to the part of the policy the CSR will need to check.

The next step comes from a pattern the system has learned over time. For e.g. ID card requests fall into the same workflow, lienholder changes follow another pattern, billing questions follow a third.

The AI component chooses the pattern that fits and drafts the expected action in the same style the team uses. The timing suggestion comes from a small rules layer that looks at the type of request, the carrier involved, and the agency’s existing renewal cadence. Urgent items get a shorter window, carrier-dependent tasks get more room, and renewal-adjacent emails are placed on the agency’s standard renewal track.

Tools (using the shared layers defined earlier)

| Layer | Common Options |

|---|---|

| Workflow Sequencing | n8n, Make |

| AI Processing | Claude 3, GPT-4.1, Gemini |

Voice processing may be included if voicemail is a frequent channel.

How teams use it

A CSR or Account Manager opens the structured list at the start of the day or between client calls. It is used to determine the next task without re-reviewing the inbox. If multiple staff members share the inbox, the list helps clarify which items are waiting on external responses and which are ready for action. Producers are looped in only when a discussion or renewal decision is required.

Try this next week

Pick one shared inbox or service queue. Generate a structured list once in the morning. Refer to the list rather than revisiting messages individually throughout the day.

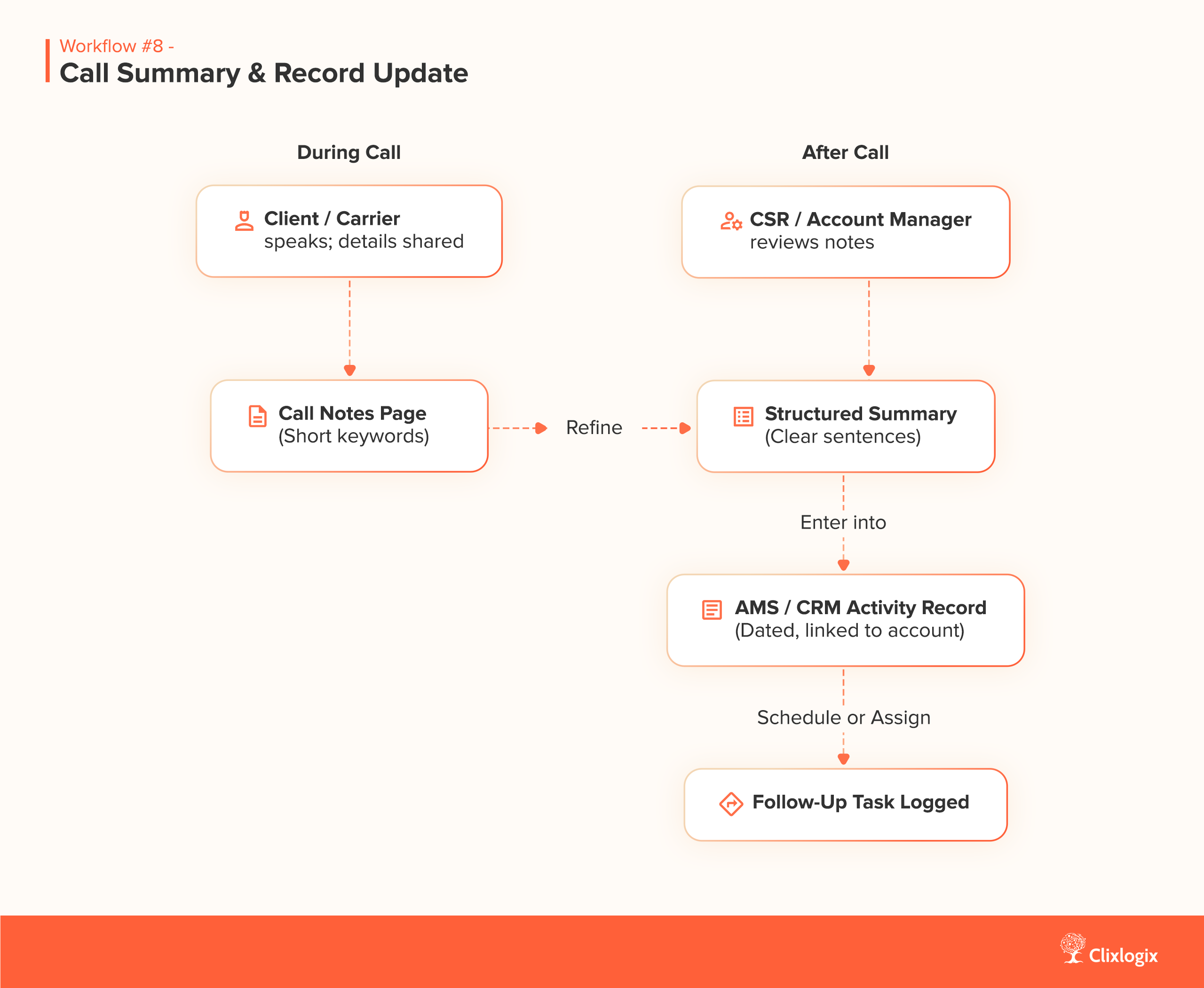

What it addresses

Calls with clients or carriers often involve multiple details that need to be recorded. Notes taken during a call may be brief or shorthand, and key points can be easy to overlook when updating the system of record afterward.

How it works

The workflow starts by capturing the call audio through the agency’s phone system or a call-recording tool and turns it into text using a speech-to-text engine. The transcription is cleaned, filler words removed, speaker turns separated, and background noise filtered out. All this helps a CSR by not having them make sense of raw output.

The cleaned text is then routed into the AI engine. This is where the interpretation happens. The AI processes the call as a single narrative and identifies the parts that carry operational value. These are generally items like – what the client asked, what changed, what needs attention, and which part of the policy the update relates to. To do this, it uses the same account context the orchestration layer retrieves from the AMS or CRM. This context includes fields like vehicles, drivers, effective dates, open tasks, recent endorsements. Because of this the interpretation stays grounded in actual policy data.

The AI component rewrites the conversation into a clear internal record eg. client’s request, the reason behind it, any details the CSR may need to confirm, and the next step for the account. When the update touches a policy field, like a mileage change, a garaging update, or a new driver, the component highlights it so the CSR knows exactly what to update.

Tools (using the shared layers defined earlier)

| Layer | Common Options |

|---|---|

| Workflow Sequencing | n8n, Make |

| AI Processing | Claude 3, GPT-4.1, Gemini |

| Voice Processing (optional) | Deepgram, Whisper.cpp |

How teams use it

A CSR or Account Manager uses the workflow after a call to produce a structured internal note and ensure follow-ups are captured. If the Producer is the one who spoke with the client, the CSR may generate and log the summary afterward based on the Producer’s notes. The summary becomes part of the account history.

Try this next week

Choose one call today that requires your team to do note-taking. Generate a structured call summary and add it to the account file.

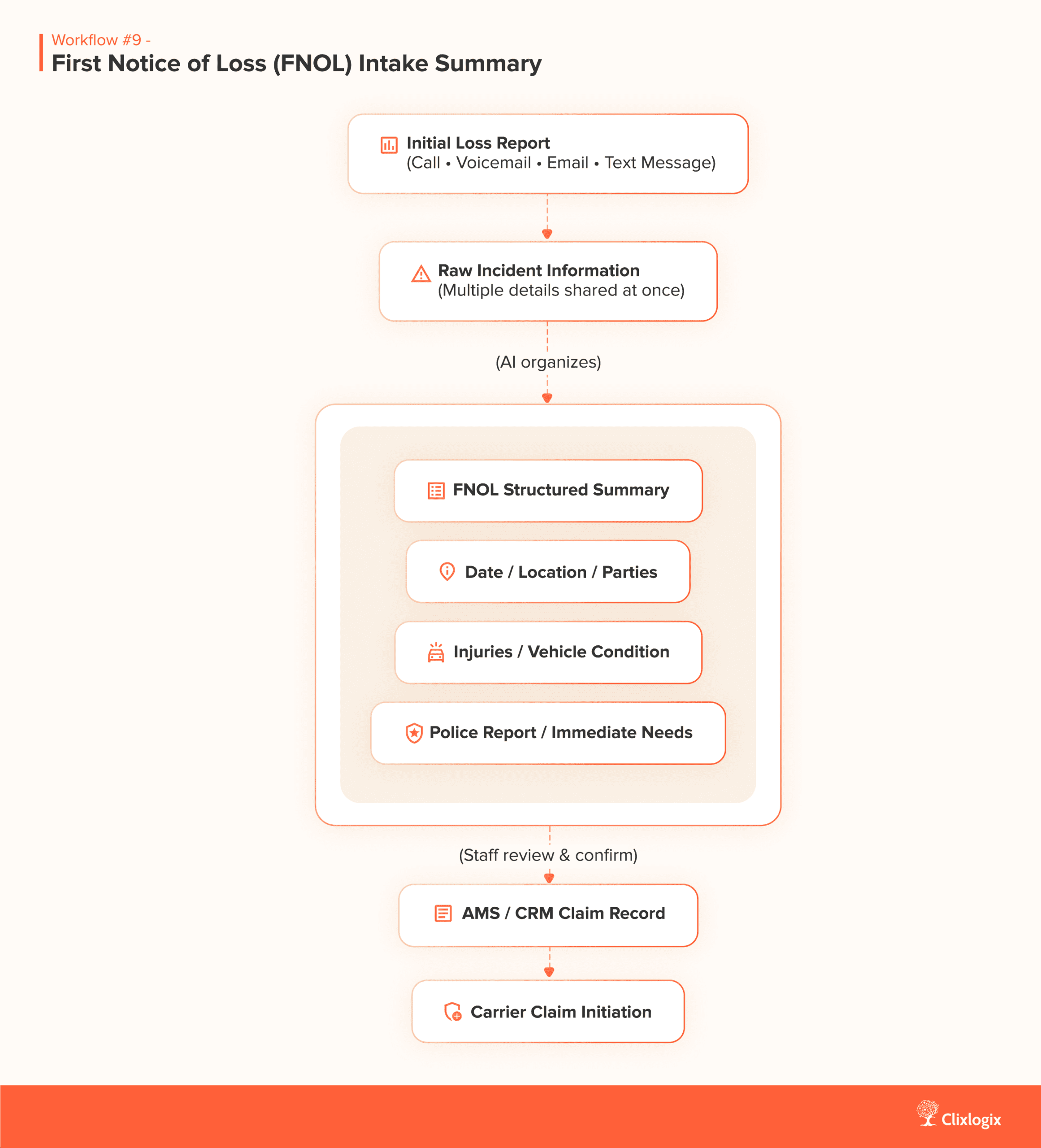

What it addresses

FNOL intake is often the first moment a client reaches out after an incident. They may call, send an email, upload photos, or forward a carrier notice. The CSR or claims coordinator needs to understand what happened, gather the right details, and begin the documentation that will shape the rest of the claim. The information usually arrives in pieces like client descriptions, photos, police reports, carrier emails. This allows the team to stitch it together before creating a clear claim record. This workflow supports that moment by preparing a complete, organized summary so the claim can be opened with fewer gaps.

How it works

The workflow begins by gathering everything the client submitted about the incident. These submissions include emails, call transcripts, photos, police documents, or carrier notices. Workflow then links the material to the correct account using identifiers from the message or data pulled from the AMS or CRM. The orchestration layer then retrieves the policy information tied to the loss: the vehicle involved, the coverage in force, deductibles, drivers, lienholder details, and any recent endorsements. This sets the foundation the system uses to understand what the client is reporting.

All incoming material goes through a preparation step before the AI component sees it. Text is cleaned to remove signatures, unrelated threads, and formatting noise so only the event details remain. Images are normalized, rotated if needed, resized, and filtered for clarity and passed through OCR when they contain visible text such as street signs, police-report fragments, or dashboard indicators. Basic metadata is captured when available, including timestamps and location tags. A visual embedding model extracts general features from each image, such as damaged panels, broken glass, road conditions, or whether multiple vehicles are visible.

Once all inputs are structured, the AI component reads them together as a single event narrative. It identifies what the client described, when the incident likely occurred, which vehicle or driver appears to be involved, and how the description aligns with the coverage information retrieved earlier.

With that context, the AI component drafts a clean internal summary: a plain-language description of the event, the policy elements that are likely relevant, and the immediate next step the agency normally handles. If details appear incomplete such as missing timing, unclear location, or an unspecified description of damage the AI component highlights them so the CSR knows what to confirm during follow-up. The workflow never opens the claim or updates the AMS/CRM on its own.

Tools (using the shared layers defined earlier)

| Layer | Common Options |

|---|---|

| Workflow Sequencing | n8n, Make |

| AI Processing | Claude 3, GPT-4.1, Gemini |

How teams use it

A CSR or Account Manager uses this immediately after the initial loss call or when reviewing a voicemail or client message. The Producer may provide missing details if they have the relationship. The summary is stored in the account file and used as the basis for communicating with the carrier and guiding the client through next steps.

Try this next week

Take the next incident call and create a structured FNOL intake summary before submitting the claim.

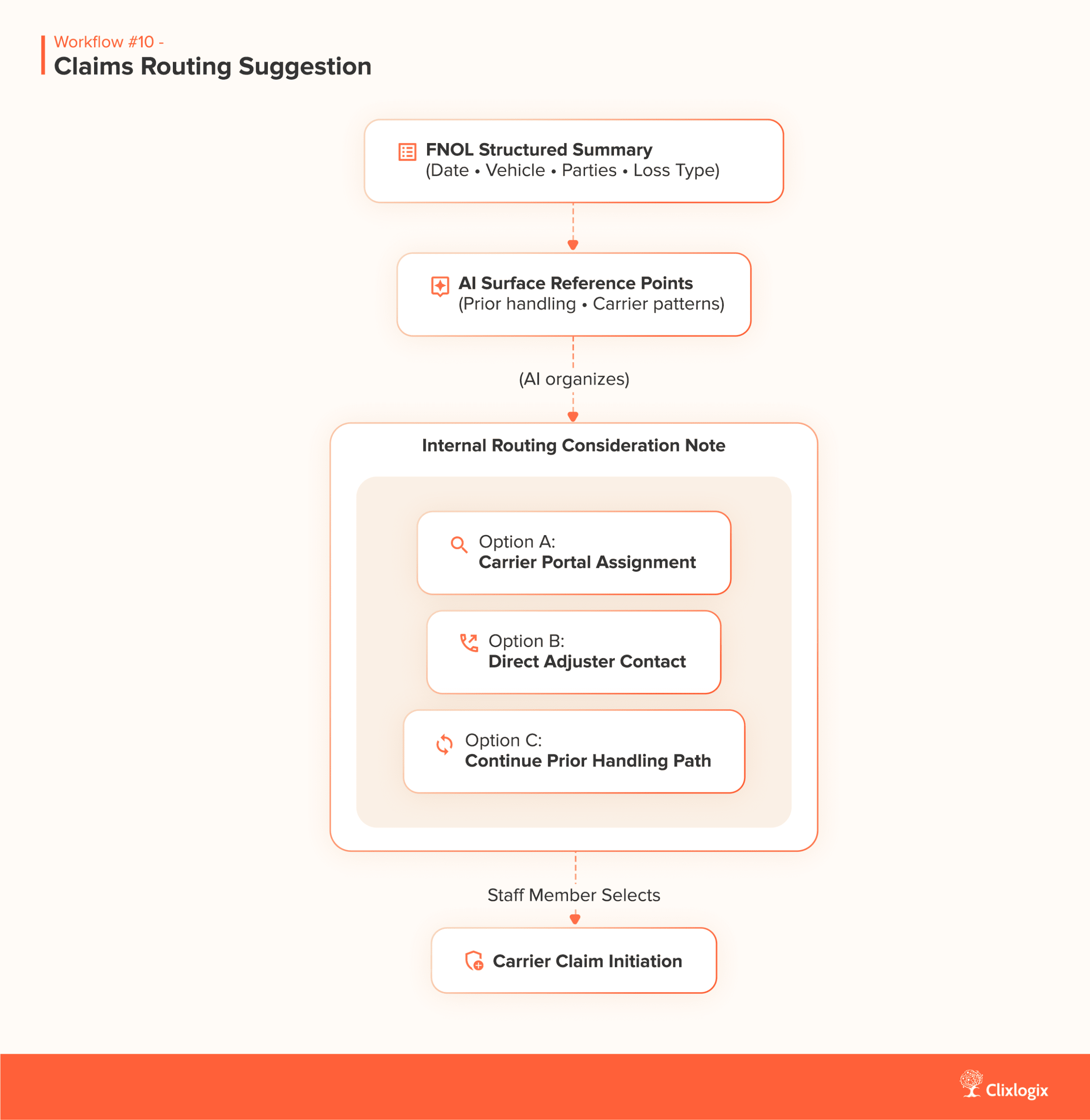

What it addresses

When a client reports an incident, the team often needs to decide who should handle the next step. Whether it’s routed to a carrier claims line, escalated to the agency’s internal claims coordinator, or queued for a follow-up once more information arrives. These decisions usually depend on the type of incident, the coverage in force, the carrier involved, and the account’s servicing structure. This can take time to reconstruct, especially when the information arrives across email, voicemail, text, or photos. This workflow supports that moment by preparing a clear internal suggestion for where the claim should go next.

How it works

The workflow begins by gathering everything the client submitted to the agency like – email text, call transcripts, uploaded photos, attachments, or notices forwarded from a carrier. As each item arrives, it’s matched to the correct account using identifiers already inside the AMS or CRM. Once the system knows which vehicle and driver this relates to, it pulls the coverage in force for that line for e.g. collision, comprehensive liability, medical payments, uninsured motorist, and any recent endorsements that might affect handling.

All of the incoming material goes through a light preparation pass. Text is cleaned and separated from greetings or unrelated conversation. Images are normalized and then straightened, sharpened, and checked for readable text. If the image contains something useful (like a street sign, a timestamp, a dashboard indicator), that text is pulled out through OCR. A visual model scans the image for broad context such as damaged areas, number of vehicles visible, or environmental conditions. It simply helps the system understand the story the client is trying to tell.

Once everything is in a usable format, the AI component reads the description, the extracted image details, and the policy information together. This is where the system starts forming the narrative: what happened, which coverage it aligns with, and which carrier handles that portion of the policy. It looks for patterns that your agency already knows well like single-vehicle damage under collision, broken windows under comprehensive, two-car incidents that typically trigger carrier-first reporting, or medical follow-ups that require internal documentation before routing.

From there, the workflow drafts a short internal note that explains what kind of event this appears to be and suggests who should take the next step? Should it be CSR, claims coordinator, producer, or the carrier directly. If something important is missing (time of loss, location, driver at the time), it’s highlighted so the reviewer can confirm it before routing.

From there, the workflow drafts a short internal note that explains what kind of event this appears to be and suggests who should take the next step, i.e. CSR, claims coordinator, producer, or the carrier directly. If something important is missing (time of loss, location, driver at the time), it’s highlighted so the reviewer can confirm it before routing.

Tools (using the shared layers defined earlier)

| Layer | Common Options |

|---|---|

| Workflow Sequencing | n8n, Make |

| AI Processing | Claude 3, GPT-4.1, Gemini |

How teams use it

A CSR or Account Manager views the routing suggestion note before opening the carrier portal. If needed, the Producer adds context or makes the final call. The workflow helps maintain continuity, especially when multiple people work on the same claim over time.

Try this next week

For the next new loss notice, generate a routing consideration note before submitting the claim.

Even though the first 10 workflows cover the most common daily tasks inside an auto insurance agency, there are a few additional workflows that are just as useful but more specialized. To keep the main guide focused, and to give you something you can save, print, or share with your team, we’ve included these 5 advanced workflows in a downloadable PDF.

Here’s a quick preview of what’s inside:

AI reviews the client’s email or renewal/claim context and auto-generates a clean, role-ready checklist of documents required. No more hunting through carrier guidelines or past notes to figure out what’s missing.

AI gathers incident details, involved parties, liability notes, and supporting documents into a structured packet. Useful for early subrogation decisions and reducing back-and-forth between adjusters and service teams.

Instead of rewriting long explanations, AI extracts the needed clarifications from emails, calls, or forms and assembles a clear brief for the underwriter. Helps speed up approvals and avoids vague submissions.

AI reads policy data, prior audit notes, and exposure changes, then prepares a simple summary highlighting what to confirm ahead of the audit. Reduces last-minute scrambling and missing information.

AI scans VINs, garaging addresses, drivers, coverages, and endorsements for discrepancies. It flags mismatches early so agencies can correct them before renewals, audits, or underwriting reviews.

Want the full breakdown? Download the 5 Bonus AI Workflows (PDF)

These workflows don’t land the same way for every book of business. The needs of a personal auto household look different from a small commercial fleet, and both differ from accounts tied to rideshare, delivery, or non-standard markets. What stays constant is the pattern: each workflow shows up at the exact moment your team needs steady context, faster reading of incoming information, and fewer back-and-forth loops.

Here’s how these workflows tend to surface across the most common agency environments.

Personal lines teams live in a steady cycle of address updates, garaging corrections, lienholder changes, and renewal conversations. Most households carry multiple vehicles, multiple drivers, and a stream of small updates tied to life changes. The workflows become a support layer as they help the team absorb those changes without losing the thread of the account. Renewal preparation summaries give CSRs a clean starting point. Coverage explanation drafts help families understand decisions. FNOL micro-flows help the team move quickly when a loss happens and a family needs clarity right away.

Fleet accounts generate more structured operational movement, such as new vehicles coming in, old units coming off, drivers rotating, certificates requested on short notice, and billing swings tied to seasonal work. The workflows act as a stabilizer. Quote comparisons help owners understand the impact of adding or removing units. Audit preparation summaries help anchor exposure discussions before the carrier review. Policy normalization surfaces VIN mismatches, outdated garaging, and vehicle lists that drifted apart over the years. FNOL flows help fleet managers communicate incidents with fewer gaps.

These accounts create fast, high-velocity servicing needs. Drivers change frequently, garaging and mileage patterns shift often, and untimely claims tend to come in late at night, during weekends, or when the workday is busiest. The workflows help teams absorb those spikes without starting from zero each time. Intake summaries turn late-night incident emails into clear narratives. Documentation checklists prepare drivers for carrier expectations. Coverage explanations help clarify where personal and commercial lines intersect. The workflows give CSRs and producers the context they need without digging through long, unstructured threads.

Accounts in non-standard markets have more movement in underwriting and a higher density of mid-term changes. Each request like address correction, payment plan adjustment, lienholder update, usually carries downstream implications. The workflows show up as a way to keep the account consistent. Normalization helps the team catch mismatches in early stages. Renewal summaries give producers a clean view of the account’s year. FNOL micro-flows help the team structure information before speaking with a non-standard carrier, where clarity matters even more.

Contractor accounts experience steady mid-term change. New equipment is purchased. Jobs are completed. Certificates are issued for different projects. Capturing these changes consistently keeps the account file clear and organized. The AI workflows help ensure each update becomes part of the record in a way that is easy to reference later.

For agency owners, COOs, and team leads, these workflows show up as fewer surprises as accounts feel steadier,losses reach the team with clearer context and renewal conversations become less reactive. Producers get better-prepared summaries. Claims routing becomes cleaner and easier to supervise. Audit cycles run with fewer “missing pieces” moments. The workflows quietly reduce operational noise, and the value tends to show up in team rhythm long before it shows up in metrics.

Rolling out your first AI workflow is about helping your team work with cleaner inputs. Agencies that start small tend to scale smoothly, because the team sees value early and naturally folds the workflow into their day. The goal here is not to rethink your processes but to make your tasks easier to navigate.

A good starting point is a workflow your team already touches dozens of times each week; it could be renewal prep, coverage explanations, certificates, or FNOL summaries. These moments are predictable, repetitive, and information-heavy.

“When AI organizes the inputs, your team moves faster without changing the way they communicate with clients or carriers.”

Every agency has a few tasks that show up constantly. These are the best candidates for a first rollout because the team immediately recognizes when the workflow helps. Instead of forcing change, you’re supporting work that’s already happening.

You can usually spot a good first workflow when it:

When a workflow fits these conditions, the benefit is obvious on day one. Your team sees cleaner prep. Your clients experience clearer communication. And there’s no pressure on anyone to adjust how the AMS or CRM is used.

Most adoption issues come from uncertainty, not resistance. A short explanation helps the team understand what the workflow does and where it sits inside their existing process. Think of it as a new internal assistant and not as a system or automation, just a clearer starting point.

Describe the workflow in simple terms:

It organizes the incoming information, creates a clean summary or draft, and highlights the pieces that need attention.

Describe what stays exactly the same:

The AMS or CRM remains the source of truth. The team still reviews, sends, and updates. Carriers are contacted the same way. Claims are created the same way. The AI workflow does not take actions on behalf of the team.

This clarity builds trust and helps the team approach week one with curiosity instead of caution.

The best way to learn is to apply the workflow inside real client cases. Real accounts carry real nuances: mismatched info, scattered email threads, complicated endorsements, or time-sensitive requests. These nuances don’t show up in test data, which is why live usage creates meaningful insights.

A helpful approach we’ve seen across agencies:

Because the AMS or CRM process remains intact, the team doesn’t feel like they’re learning a new system. They’re simply starting the day with a clearer picture.

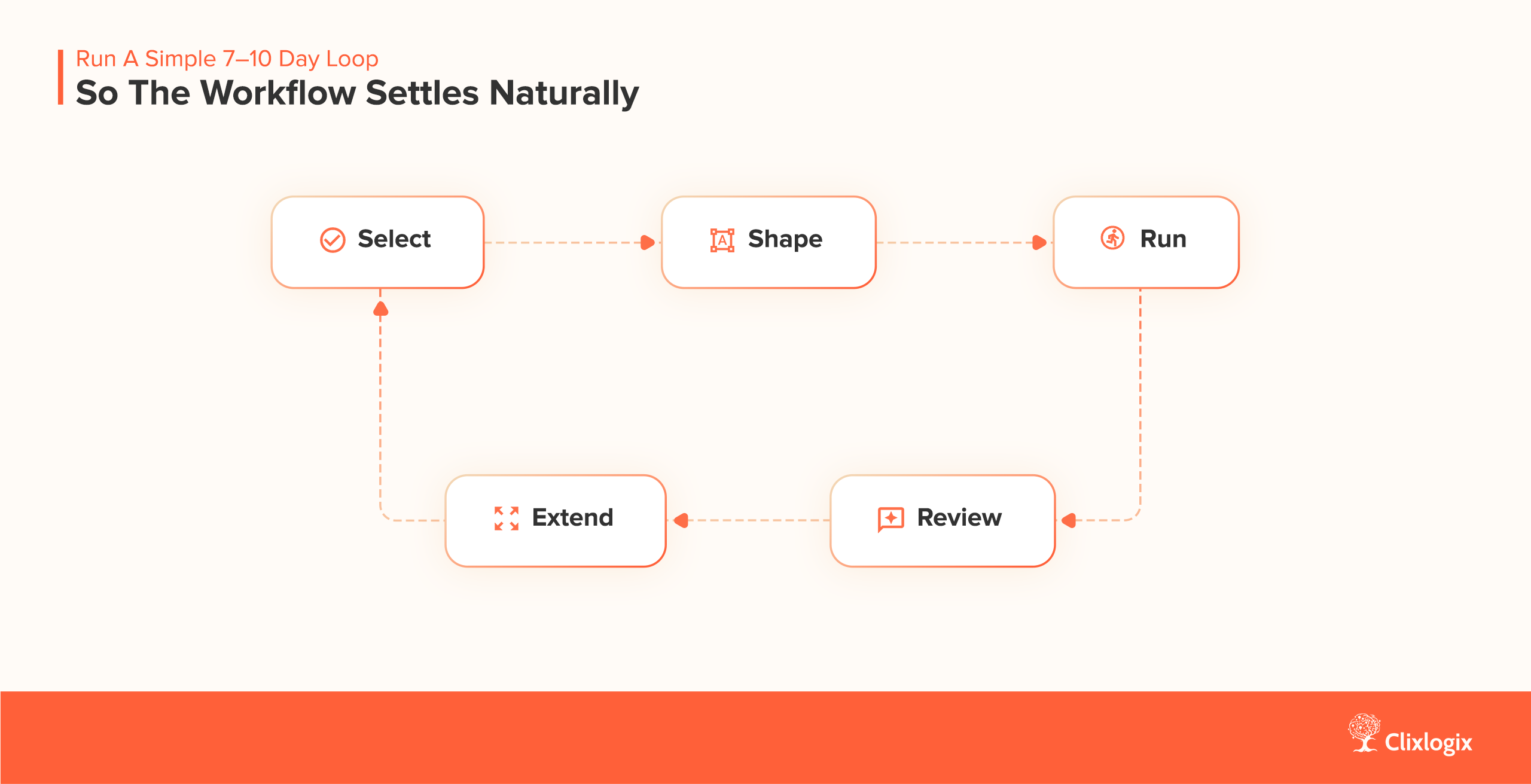

Agencies that thrive with AI tend to use a short learning cycle. It keeps the rollout structured without overengineering it.

Select: Choose one workflow and apply it to a small number of accounts.

Shape: Adjust the writing style, tone, and structure so the output feels like your agency’s voice.

Run: Use the workflow for a week inside actual service, renewal, or claims work.

Review: Meet for ten minutes. What helped? What needed editing? Where did the summary save time? What felt out of place?

Extend: Roll it out to more teammates or apply it to more account types.

This approach mirrors the way teams adopt internal documentation, new checklists, or updated intake forms. Incremental, visible, and grounded in day-to-day work.

Teams tend to adopt new workflows the same way they adopt new checklists or updated intake forms. Small behaviors shape how quickly the workflow settles into daily work.

After watching multiple auto insurance agencies roll out their first AI workflows, a few practices consistently make the transition smooth:

Small friction points in the environment tend to influence adoption more than the workflow itself. Noticing these early helps the rollout feel smoother and keeps the team from feeling like they are juggling something new on top of their regular work.

This feels like a cleaner way of starting work. Teams talk about the summaries the same way they talk about good documentation or a well-written handoff note. The workflow becomes part of the rhythm that is steady, predictable, and helpful at the very moment a case first appears on someone’s screen.

Agency owners tell us this checklist helps them feel confident before week one:

When these pieces are in place, the first workflow lands almost automatically.

When the team experiences the first workflow inside real work, the learning curve flattens quickly. Renewal prep becomes clearer. FNOL intake feels more organized. Coverage explanations start with better context. Once the team sees these small improvements, the next workflow is easier to introduce because the rhythm is already familiar.

The shift feels gradual. The team opens a case and sees organized information. They move through their tasks with fewer back-and-forth steps. Hand-offs feel steadier. The workflow becomes something they rely on without thinking about it.

As this becomes the norm, adding the second or third workflow feels straightforward. The team already understands where the summaries live, how to review them, and how they fit into the AMS or CRM. You’re building a foundation where each new workflow strengthens the same habits.

The work itself stays the same. What changes is the way information reaches the team, cleaner, clearer, and easier to move through.

These workflows are a way to keep context moving forward. They help the team begin each conversation from a known place. The AMS or CRM remains the source of record. The workflows sit around it and make the work easier to move between people.

Introducing one workflow at a time gives the team room to understand how it fits. The improvement usually shows up in tone, clarity, and hand-offs before it shows up in speed. Once familiar, the workflows become part of the routine.

If you’re thinking about where to begin, we can look at your book together. One conversation is usually enough to find the workflow that will have the most immediate impact.

If you’re thinking about where to begin, we can look at one workflow together. No software change. No new process. Just one workflow that fits the way your team already works today. We’ll map the 3 to 4 places where coordination effort stacks up, choose one workflow to pilot, shape the draft output to match your agency’s voice, and set a short review loop so the workflow settles naturally into your day.

Akhilesh leads architecture on projects where customer communication, CRM logic, and AI-driven insights converge. He specializes in agentic AI workflows and middleware orchestration, bringing “less guesswork, more signal” mindset to each project, ensuring every integration is fast, scalable, and deeply aligned with how modern teams operate.

At 7:00 a.m., dispatch boards are already full. A technician calls in about a part delay. Another forgot to close yesterday's job in the system....

Store owners in Shopify have noticed something unsettling. Traffic patterns are changing. Pages that used to rank well are getting fewer clicks, even though rankings...

If you work long enough with n8n and AI, you eventually get that phone call, the one where a client sounds both confused and slightly...